Automating your bills

Planning a world trip

By Jaimy de Vries

While there are certainly some downfalls to all the technology available to us today, it sure does help the long-term traveler, especially when it comes to staying on top of finances at home while off gallivanting the globe. Even if you’re a personal finance geek and budgeting fiend, you’re going to want to have your bills and budget streamlined and automated as much as possible while traveling. First, for simplicity sake, and also because you don’t want to have to deal with money issues while in another country which might possibly involve you just trying to verify that you are really you, just in a tiny town in Cambodia on a crappy Skype connection.

Get a Travel Credit Card

Unless you have a serious issue with self-control when it comes to credit, getting a miles/points credit card for travel is one of the smartest things you can do. Not only is it a safer way to pay for things than a debit card or cash while traveling (like when you’re buying a flight or pre-booking lodging, etc.), it’s also a safety net. If your card number or card gets stolen, your account will be turned off, and you will be protected versus waking up to realize all your money is gone from your checking account. Also, most credit cards provide a form of travel insurance benefit like travel accident insurance, purchase protection, and car rental insurance.

Automated handling expenses

While the internet is pretty much everywhere, there are going to be times when getting online is very difficult, if not impossible. Having the extra worry isn’t worth it, especially when it’s so easy to set up all your bills so they get paid automatically. The key to this, of course, is making sure you have enough money in your account to make those payments. You need to come up with a financial plan. Some just have all their money in a checking account, so this would be a moot point. But for those who have their money spread out amongst different accounts, keep in mind that it often takes up to five business days to transfer funds while on the road and not near your bank, so either consolidating most of your funds into one or two accounts pre-departure or having a plan in place is essential, especially for those times when you know you may be in the middle of nowhere without internet access.

Next, any current expenses that you can automate (utilities, credit card, student loans, etc.) should be set up to automatically withdraw from your main checking account so that you don’t have to worry about paying any bills while on the road. While on a world trip this might include things like insurance, storage expense, student loans, etc. Then you’ll just have a cursory monthly glance to make sure everything looks okay.

Student Loans

Many of us have student loans to worry about. It’s not terribly difficult to defer them if you aren’t going to have any money coming in while you’re on the road and simply don’t have the funds to keep paying them. If you have student loans that aren’t at too high of an interest rate and it would make your budget/life easier while you’re traveling, it might make sense to either defer or switch to interest only payments while you’re gone. Since everyone’s loan situation is slightly different, this is something only you can decide, but it might make sense to call your student loan provider and just ask them what your options are. Explain the situation and see what you can do. Alternatively, deferring payment on a student loan while traveling can be a huge relief, knowing that you don’t have to worry about it for a year. This is a decision that everyone needs to make based on their own personal financial situation.

I didn’t had a high student loan. My student loan debt was: € 3.241,96 and my monthly payment was €45,41. But still could’ve cost me this more than €1000,- during my world trip. I asked for a 3 year deferment of my payments and this was okay.

Cancel services

The last step of automating things is to actually stop and shut some things down! This won’t apply to everyone, but if you, for example, already have a set amount of money transferring to a savings account after each paycheck, you’ll want to remember to pause this monthly transfer if you won’t be receiving income during your trip so you don’t end up with your account balances all out of wack and not have access to your money.

When you have a departure date, it’s time to start canceling services that you won’t be using while on the road (gym membership, utilities, Netflix, etc). Set reminders as needed to verify that they did indeed get canceled and you’ve received and paid your final bills. As soon as you can get this done, it feels quite liberating.

Have a go-to person at home

Designate a “power of attorney” at home. Sounds scary, right? Pretty much all we’re saying is that you should have a go-to person back home who can handle anything that comes up. In this day and age of digital signatures, this probably won’t be an issue. However, if something unexpected comes up, it’s always nice to know that you have one person to email or call him/her to give them a head’s up that you’re in need of a little remote assistance. And remember when picking this person, that they should be one of those people who doesn’t have time management issues. And that you absolutely trust, as you may want to give that person access to your bank accounts should you need money moved around in a pinch. If you automate the bill process as much as you can, you

hopefully won’t need this person much, if at all, but it’s important to have someone in case of a “what-if” scenario. Now all you have to do is remember to call your bank to let them know when/where you’ll be traveling so, they don’t cut off your access, and you’re good to go.

My to go person at home is my mum, I trust her 100% and she is good with finances. I don’t know if I really need it, because all my bills are automated or cancelled, but knowing that of something happens she is there to help me.

Sign up for an online money management software

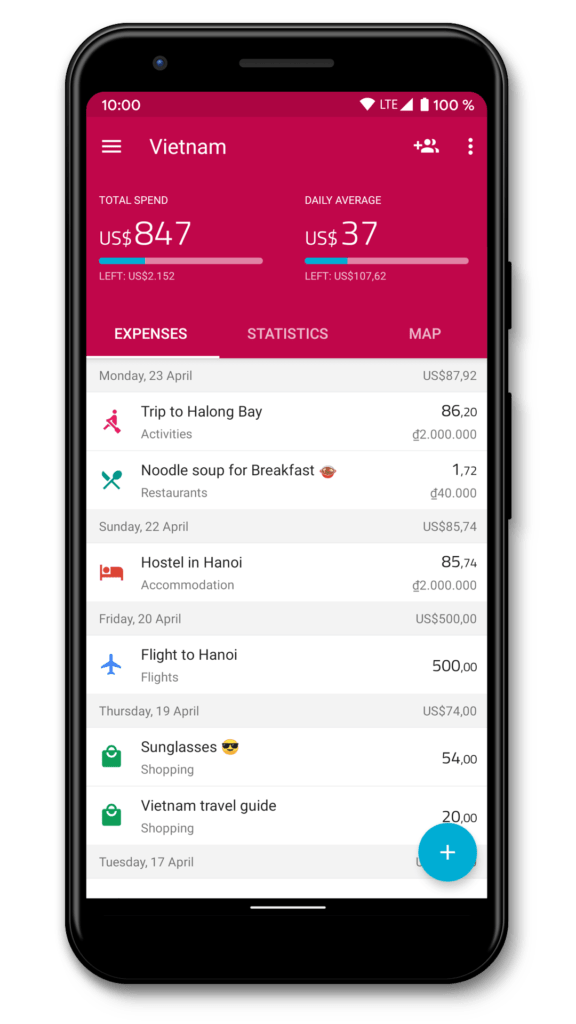

To manage my finances along the way I’ll keep track of my spending’s on the app: TravelSpend. I know myself, I know that I can start very enthusiastic with spending money on activities, souvenirs and good food. But I must stay within my budget! Otherwise I need to skip some countries because I’m already out of money. Besides managing my own finances I want to keep track of my expenses to help & inform others in planning their world trip.

Travelspend is a great tool to achieve these goals, because:

- It helps making it easy for me to add expenses on the app while on the go. Adding new entries in TravelSpend is quick and easy. It works offline and foreign currencies are automatically converted.

- It helps me to stay put on my budget. It keeps track of my travel budget and all my expenses. This will help me cut costs and save money.

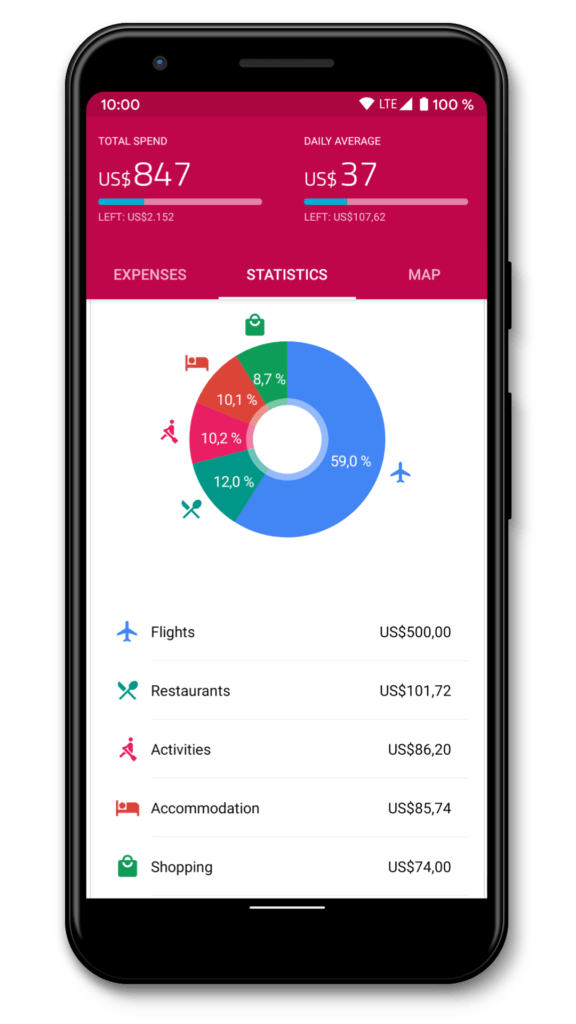

- It helps me to gain insight of my spending’s. My spending data is visualized. I can analyze my expenses and avoid overspending. Some places are naturally more expensive or cheaper than other, and with this app it’s easier to view the differences.

To see how much the actual costs of my world trip is, you’ll need to wait at least two years to find out. Over two years I’m back from my world trip and then I’ll have all the numbers – received throughout this app – that, of course, I’ll share with you!

Special thanks to Bootsnall.com for all the guidelines and information on how to plan a round-the-world trip!